Write-off the loan

What is a Loan Write-Off?

A loan write-off occurs when a bank or lender removes a loan from its balance sheet because it considers the loan to be uncollectible. This typically happens after all reasonable attempts to collect the debt have failed, and the loan is categorized as a loss.

The write-off doesn't mean that the borrower is relieved of their obligation to repay the debt; rather, it signifies that the lender has acknowledged that the chances of recovery are minimal.

In summary, a loan write-off is a crucial tool for managing a bank's financial health and risk exposure, but it also offers insights that can drive better decision-making and operational efficiency.

How it works at Neofin

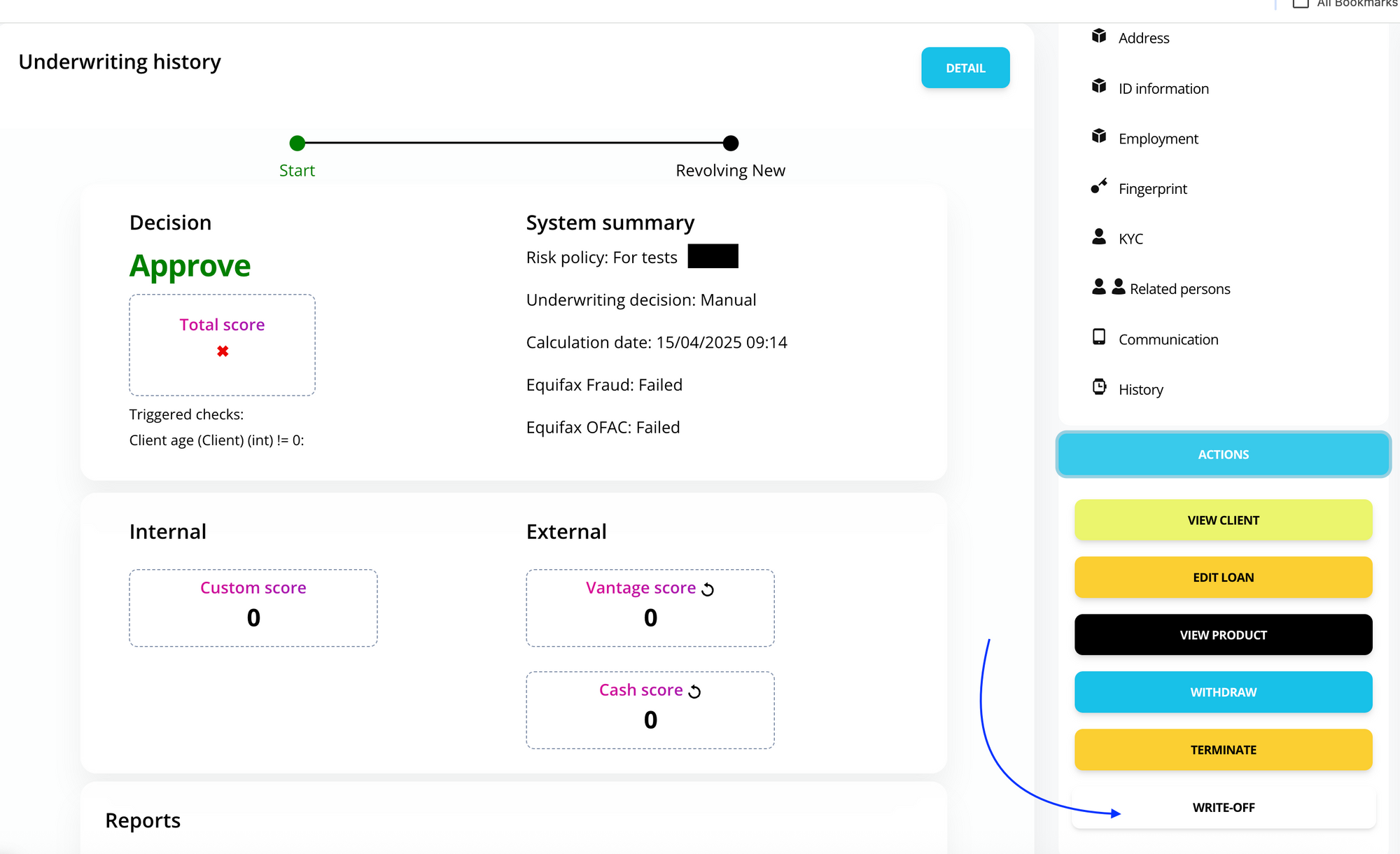

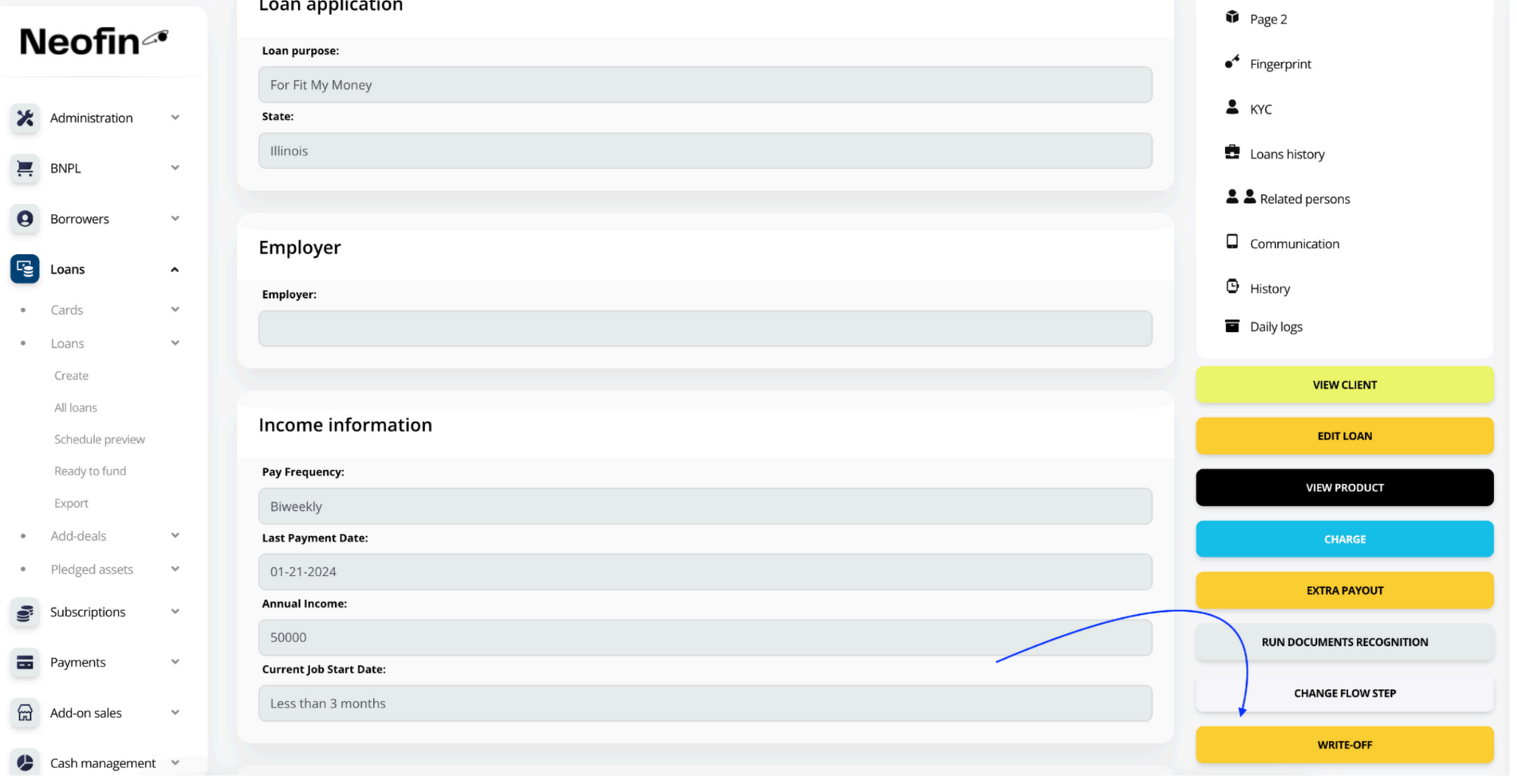

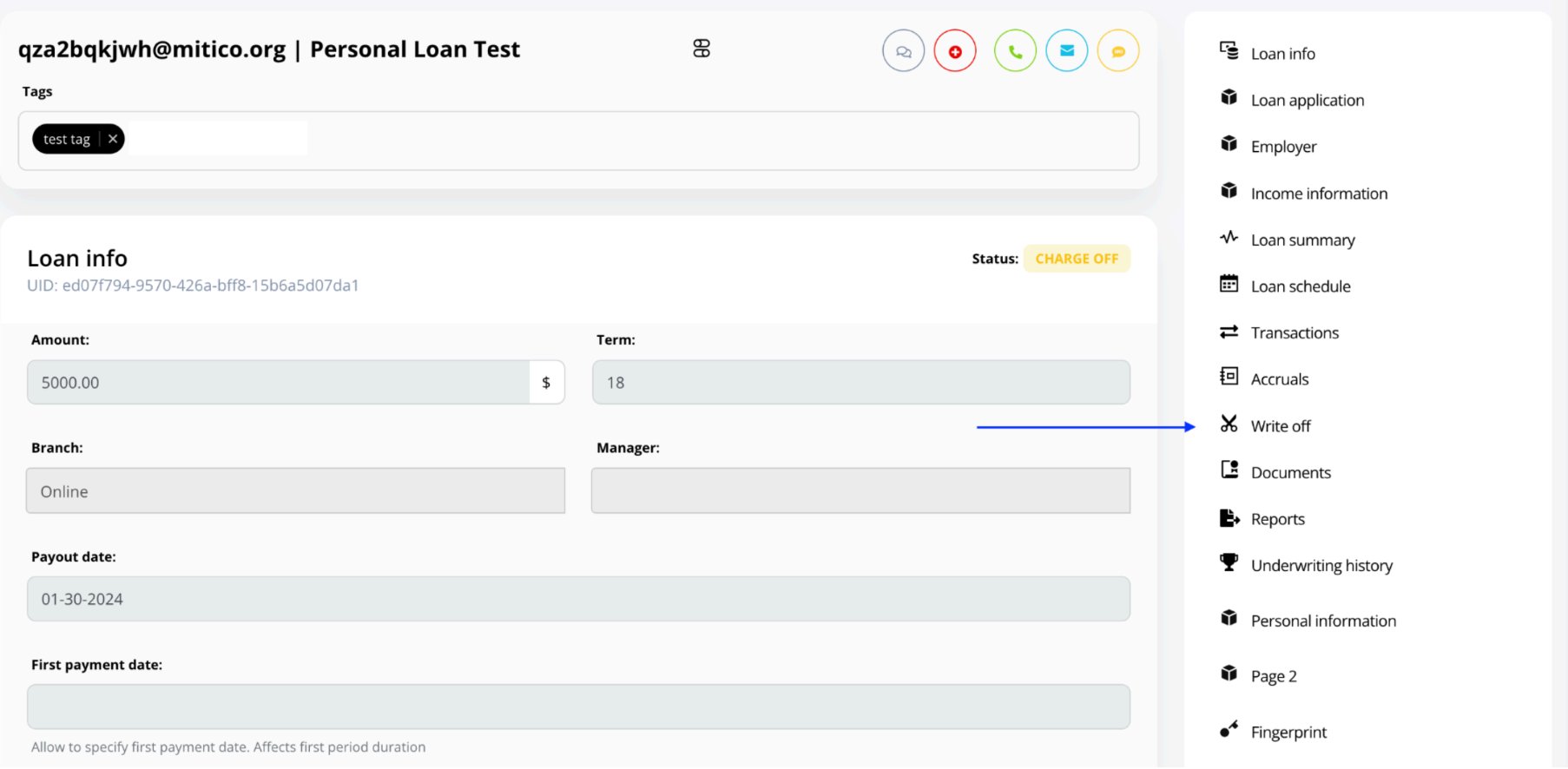

- Open an application that has 'Overdue' status

2. Click to Write-Off

3. Follow these simple steps to have the Write-off completed

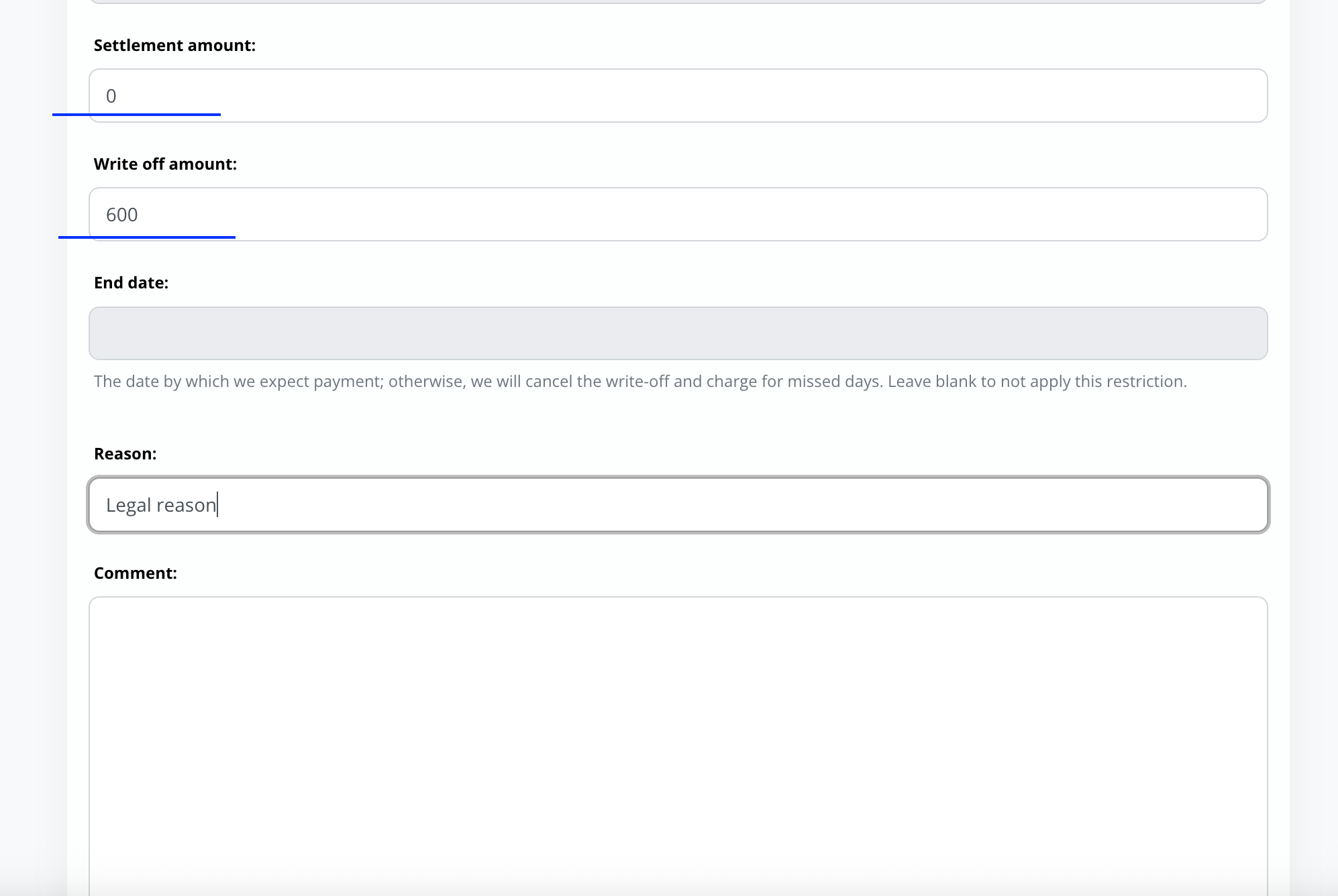

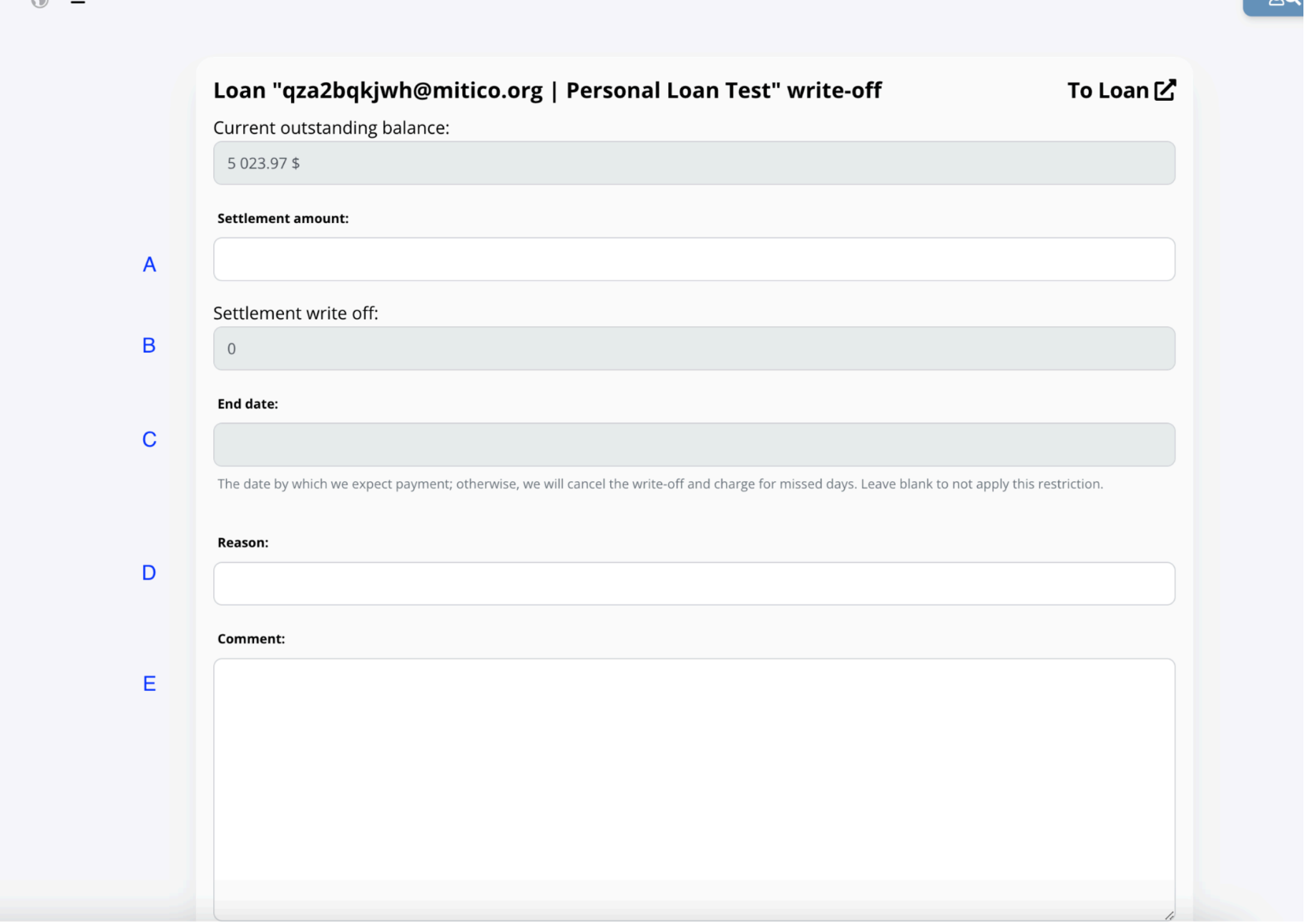

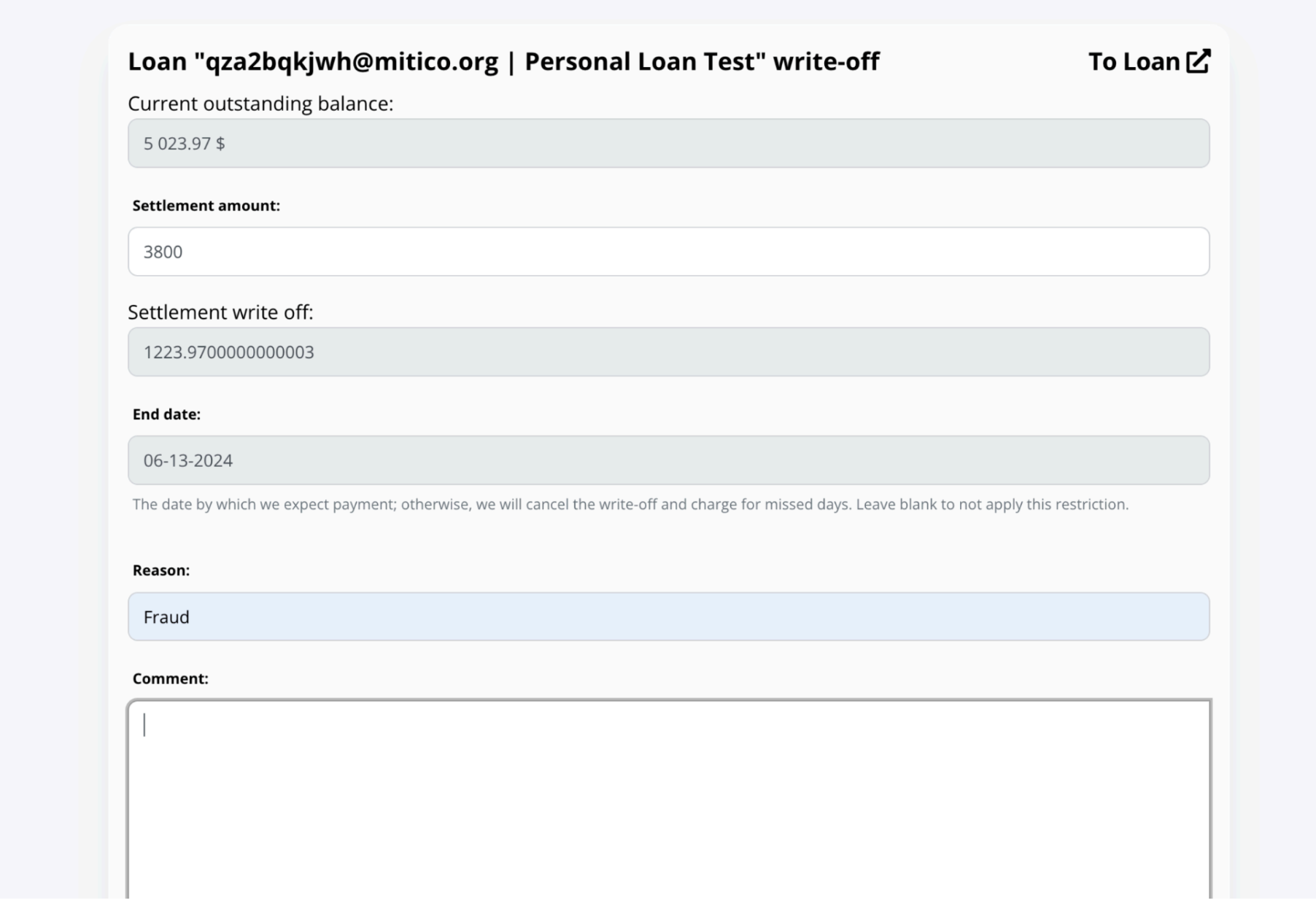

Fill out the general information

A) The amount that the client should pay to close the loan

B) The system automatically calculates the amount that should be a write-off

C) Until this specific date loan has the Write-off status and the Neofin as a system waits for the client’s income payment

D) Reason that describes why the manager (administrator) allows to make a write-off possible for client

E) Any kind of comment for this Write-off request

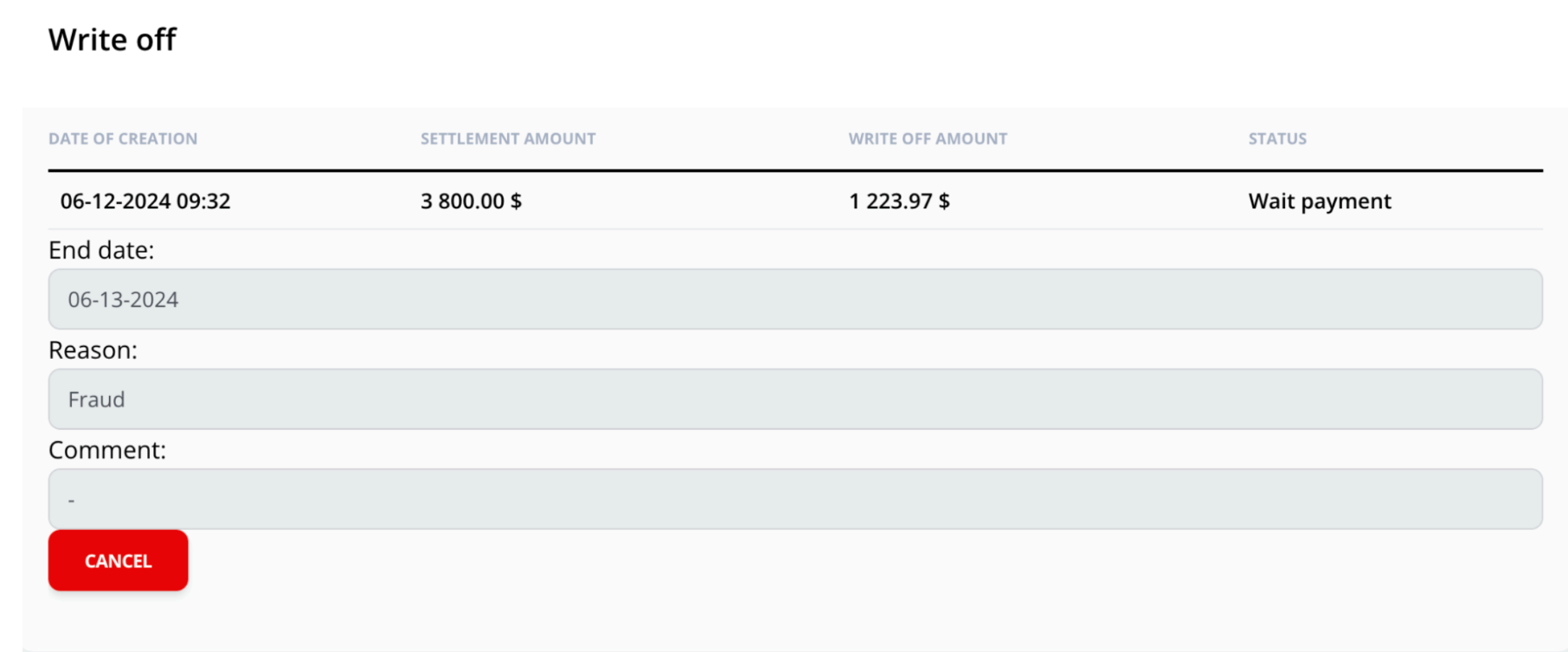

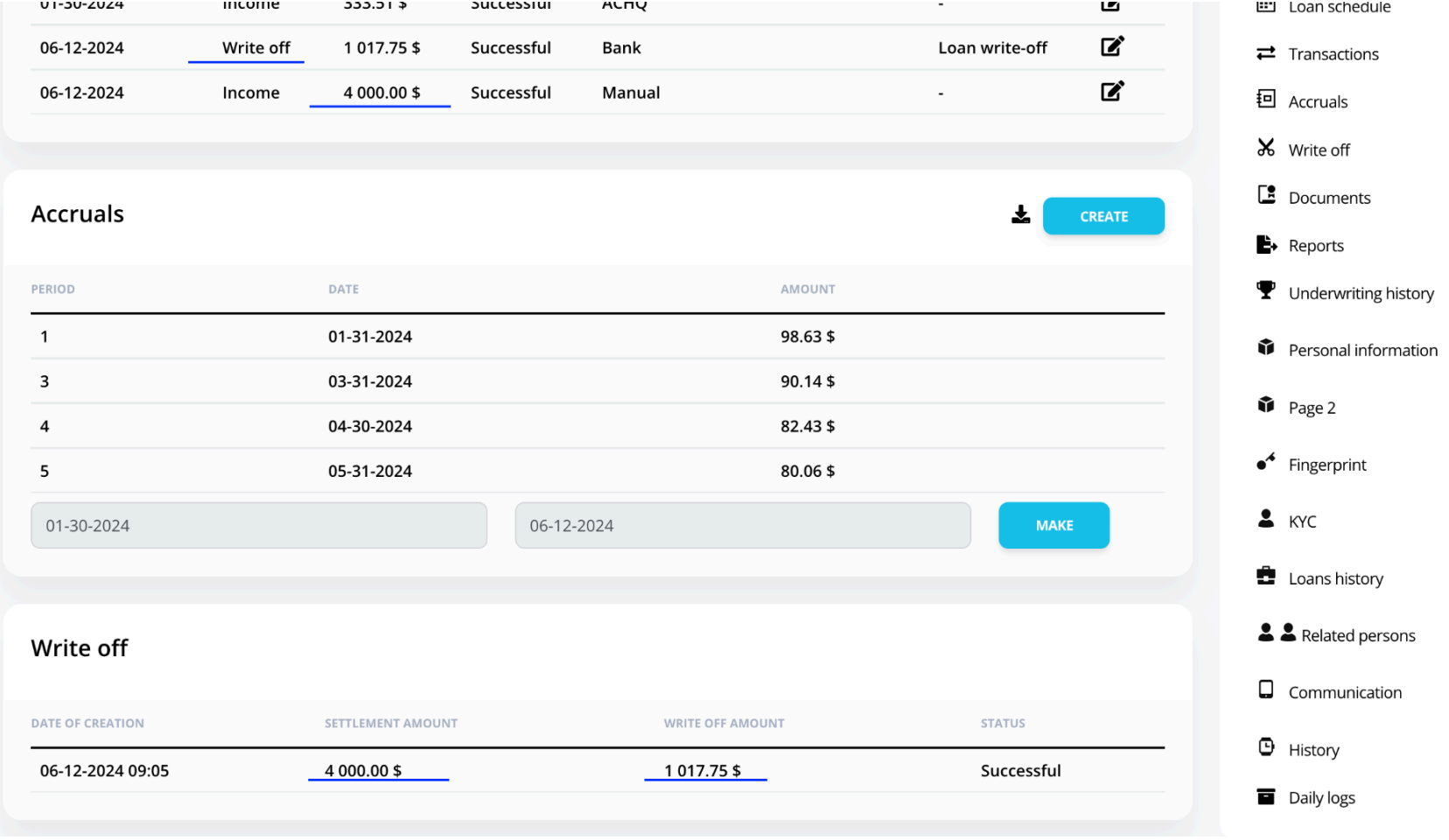

3. The system waits for the payment from the client. Managers can create transactions manually.

4. Follow to Write-off tab to check what amount should be paid and what amount automatically would be reduced.

In the tab, you can discover additional information with status.

Important: if a payment amount is equal to or more than the settlement amount Neofin will create a write-off transaction automatically.

And the status of the write-off will be changed,

The loan status will be changed to 'Closed' at the same time.

Use this test case

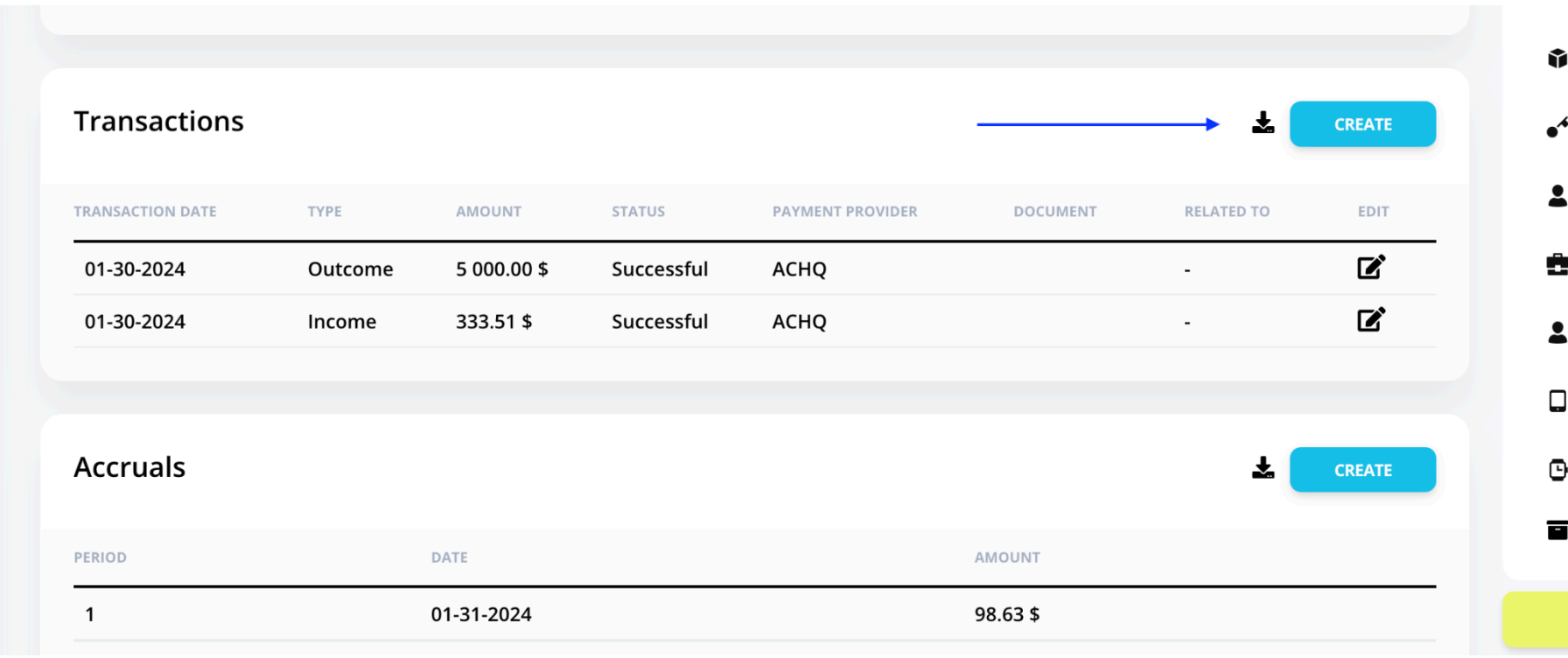

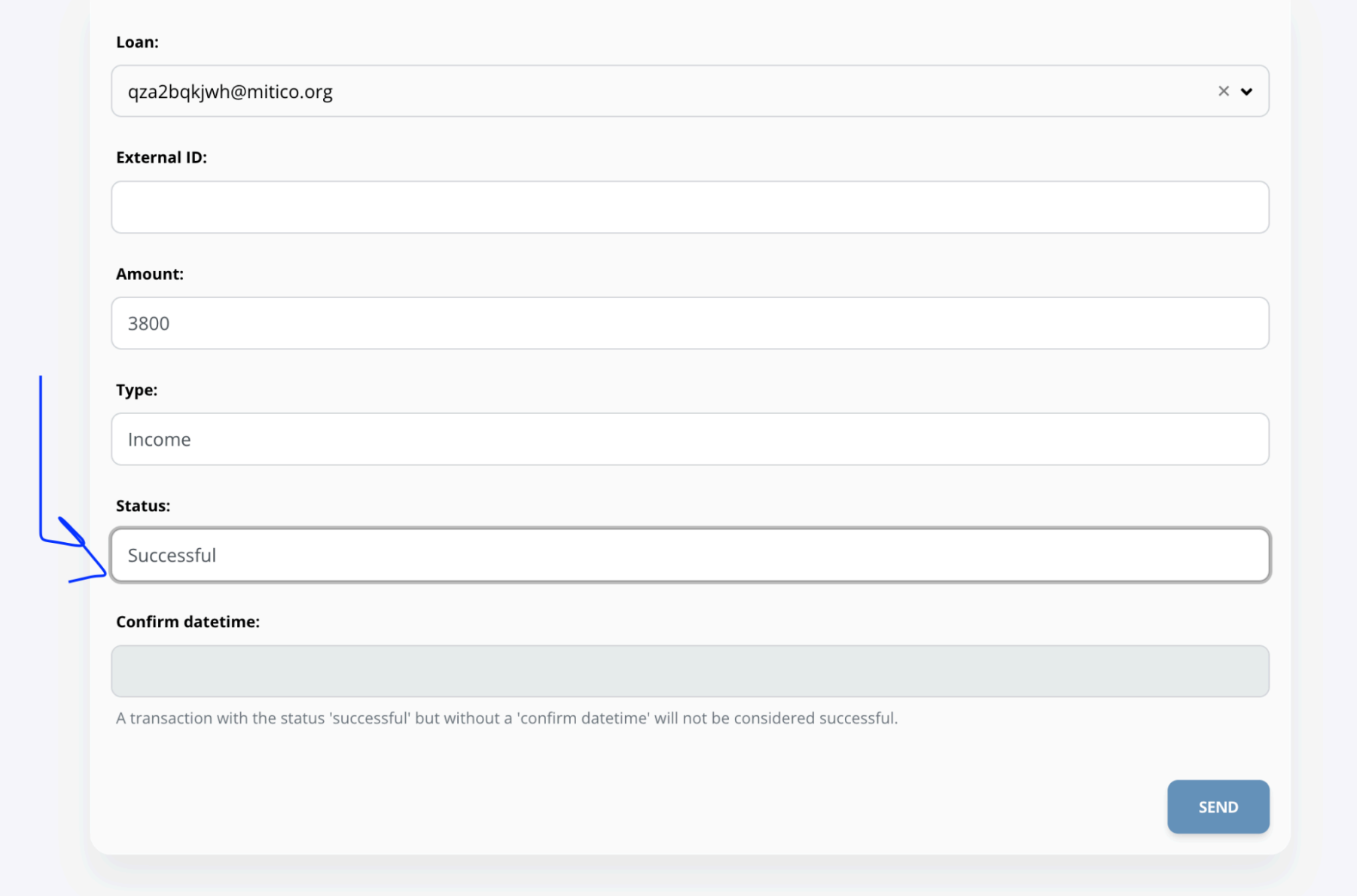

A) Create an “income” transaction with the settlement amount

Do not forget to use the correct confirmation date

2) Pay attention to status. The status should be 'Successful'

In the list of transactions, you find two find two different items

Write off transactions and Income that the client has done.

How to Process a Write-Off in the Debt Collection Component

When managing outstanding debts, there are cases where you need to perform a write-off to account for unrecoverable amounts. This guide will walk you through how to execute a write-off for various parts of accrued interest—Principal, Interest, and Penalty—within the Debt Collection component.

Step-by-Step: Executing a Write-Off

Open the Debt Collection Component

Navigate to the relevant debt record within the Debt Collection interface.

Click the “Write-Off” Button

On the debt entry, locate and click the Write-Off button. This will open the write-off request form.

Enter the Write-Off Amount

Specify the total amount you wish to write off.

Example: USD 600

Distribute the Write-Off Amount

In the right-hand side menu, find the Distribution Rules tab.

Allocate the Amount Across Components

Input the appropriate amounts for Principal, Interest, and Penalty based on your allocation strategy. Ensure that the sum of the distributed amounts equals the total write-off amount.

Save the Request

Once you’ve correctly entered the distribution, click Save to submit the write-off request.