Applying for a Loan Online

Here we look at the steps your client will need to follow to apply online (without visiting an office).

Please note: to ensure that your client can proceed with steps below, pre-configure the corresponding settings during the User Flow Editor step.

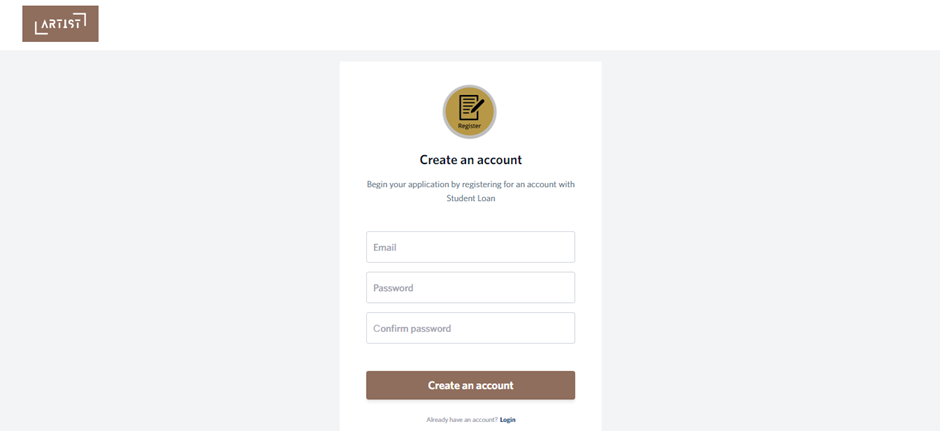

1. Register on the website of the financial organization that will issue the loan. For example, a page with a registration form might look like this:

Enter your e-mail address, create a strong password and click Create account.

2. Follow the link in the email sent to your inbox to confirm your registration.

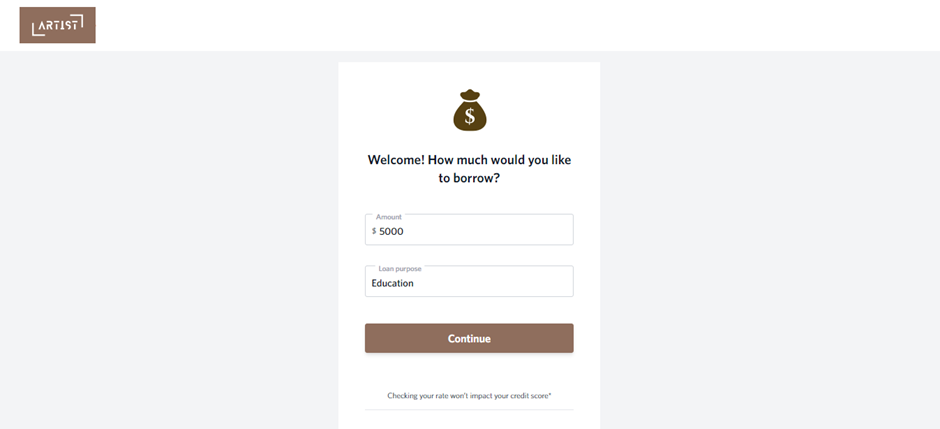

3. Next, fill out the fields that you have pre-configured in the Form Editor.

Specify the loan amount and for what purposes you need it.

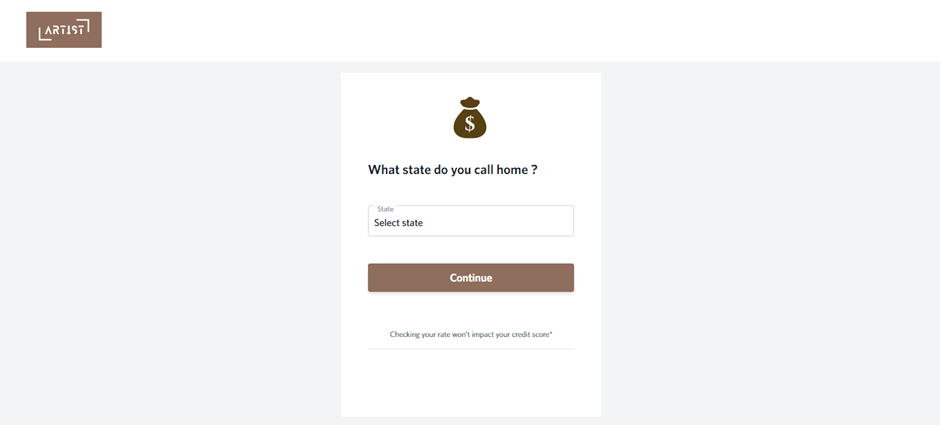

4. Specify your region of residence.

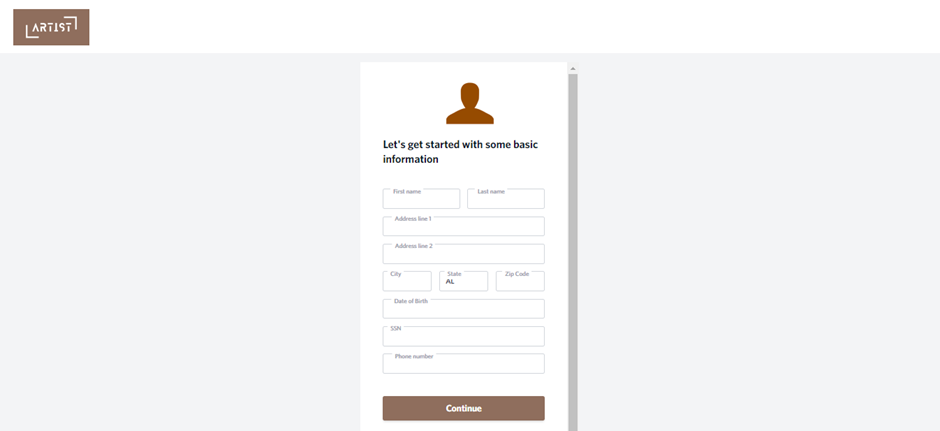

5. Provide basic information about yourself.

6. Provide your income information.

7. Confirm your application.

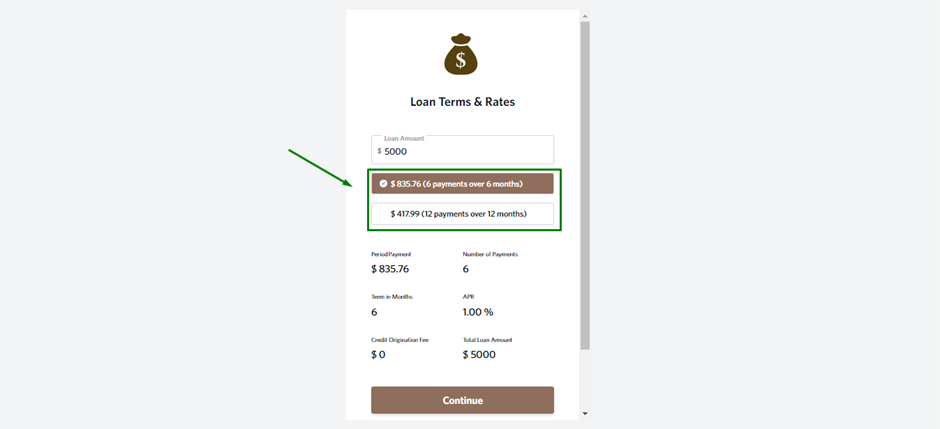

8. Next, the system will select a loan product for your application depending on the settings configured during Origination step. Select a product and click Continue.

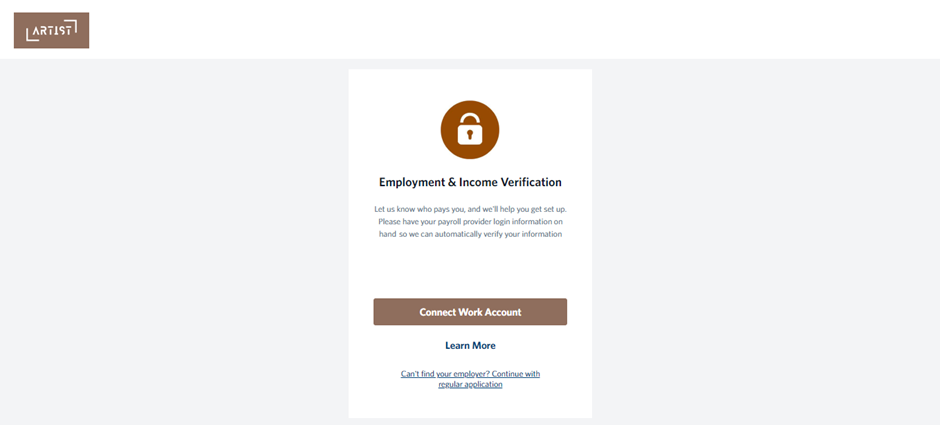

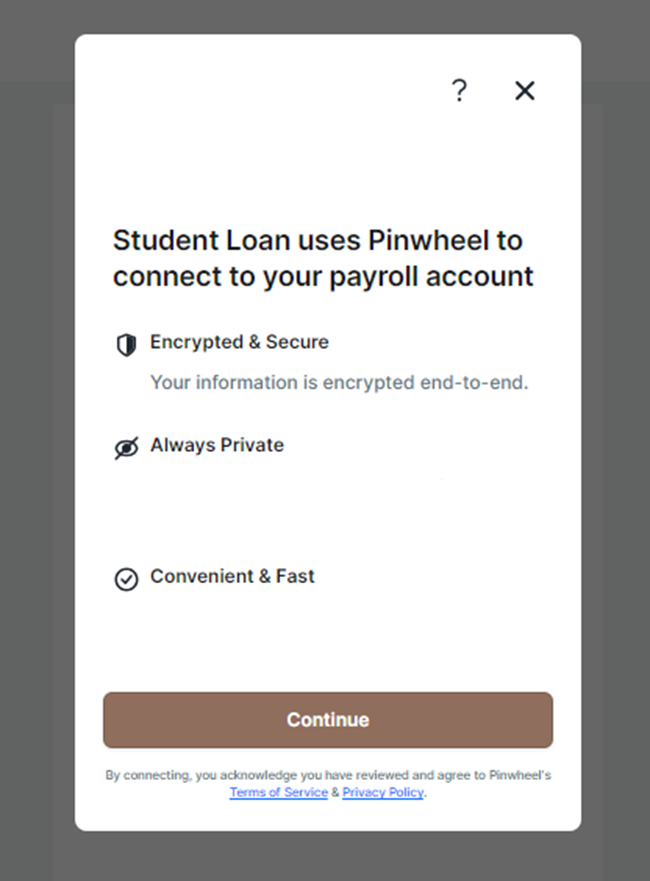

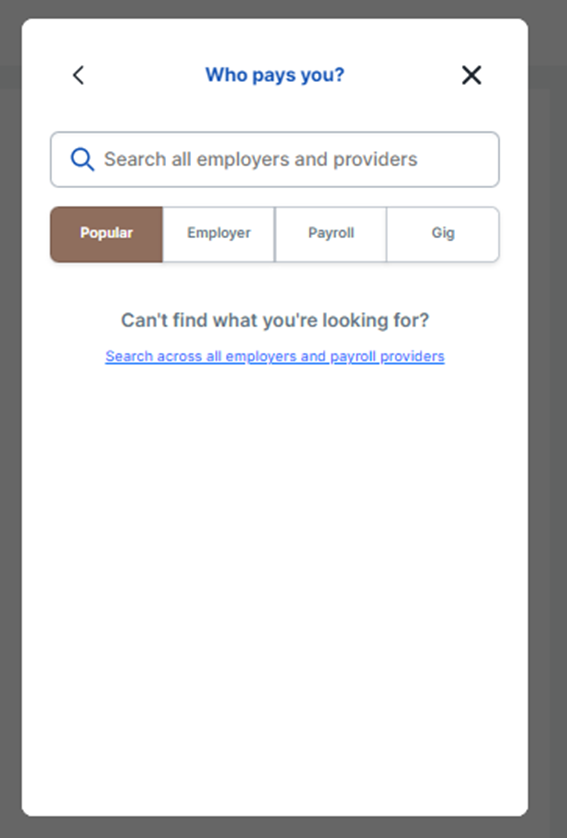

9. Next, connect your work account to enable an additional verification by the system. You can skip this step if required.

For more information about connecting third-party services (providers) refer to the Settings instructions.

Click Connect Work Account.

Then click Continue.

Enter the name of the company you work for.

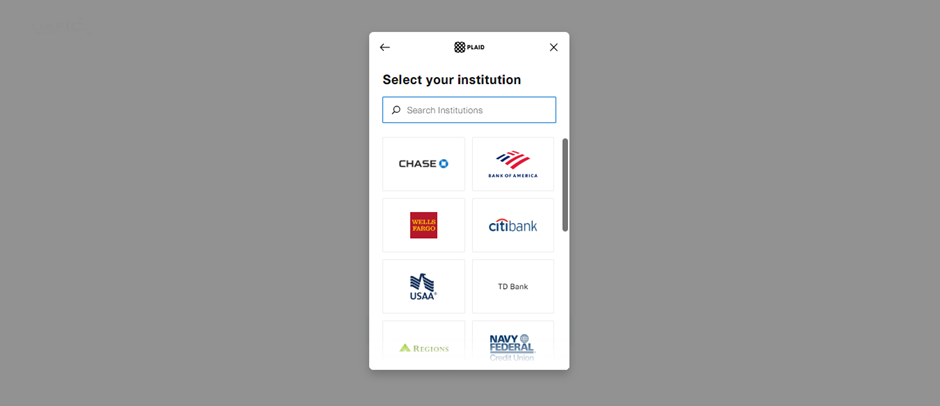

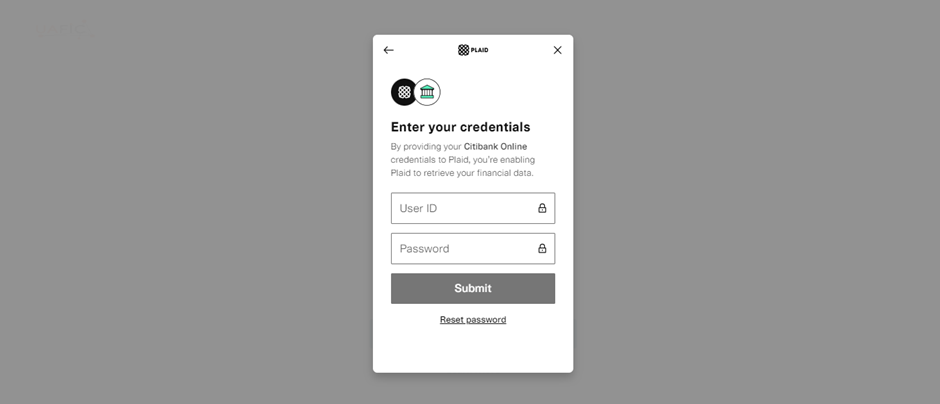

10. Connect your bank for verification. For more information about connecting third-party services (providers) refer to the Settings instructions.

Once you have selected a bank, enter your login and password to synchronize with the bank.

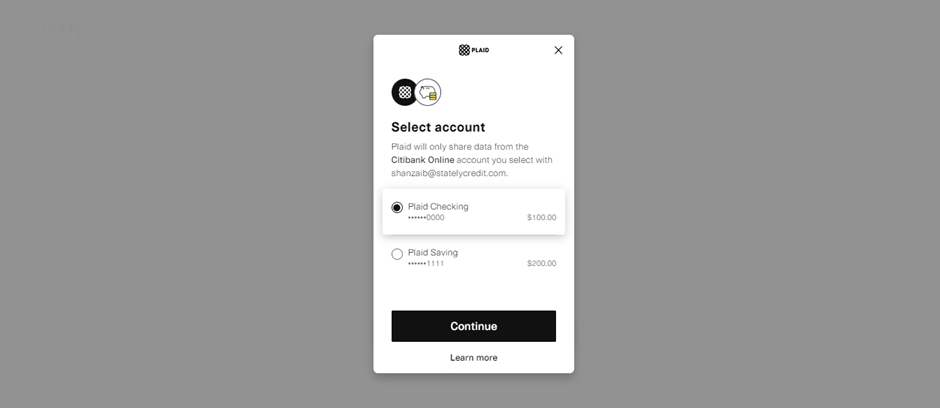

Select a bank account and click Continue.

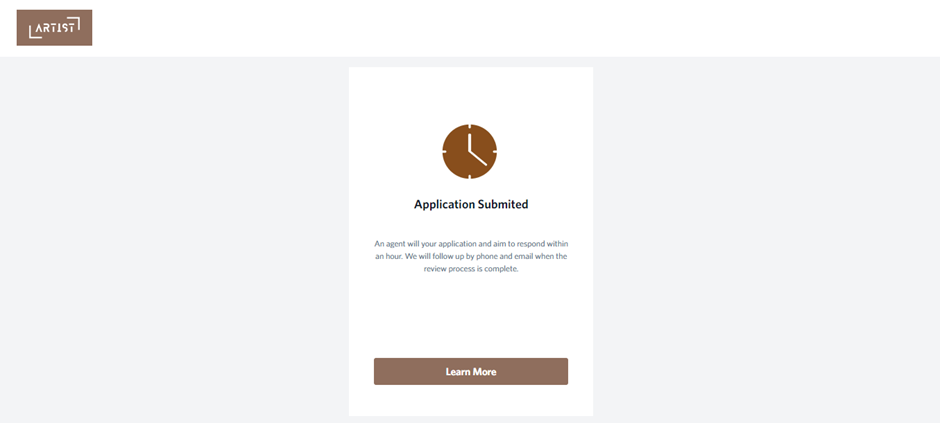

11. You will then see that your application has been submitted.

Based on the settings configured during Origination step, the application may be processed either automatically or manually by a manager.

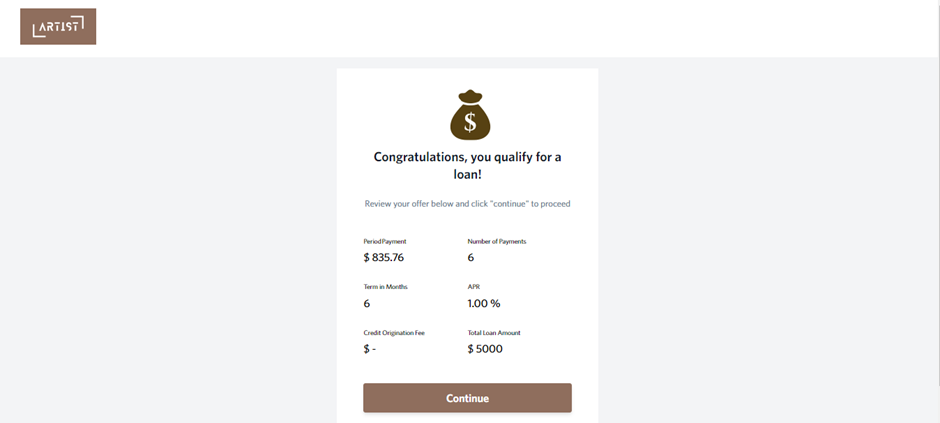

Once your application has been approved, you will see the relevant information on the page. For example:

12. Next, generate documents for signature.

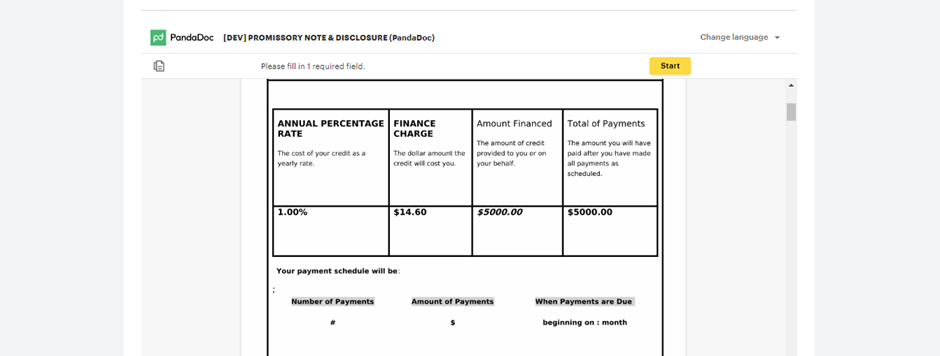

These documents show the variables from the client’s application form and the variables that you previously configured in the documents (Document Settings in the Loan Management System).

Sign the proposed documents using the PandaDoc service. For more information about connecting third-party services (providers) refer to the Settings instructions.

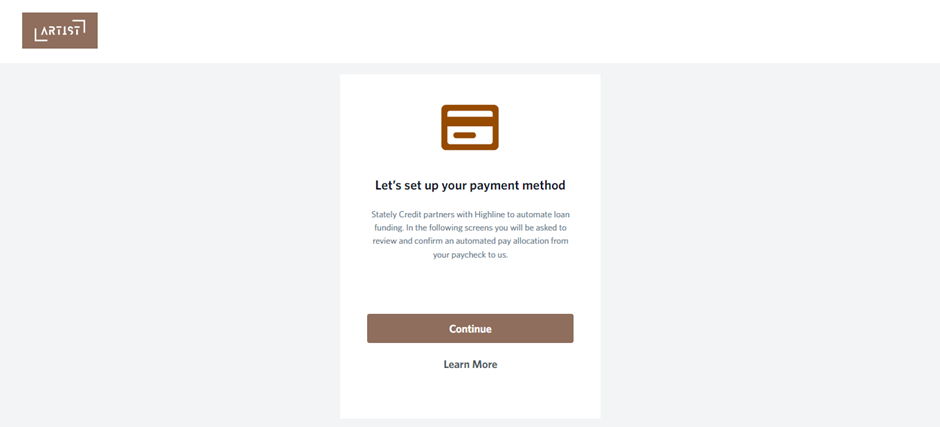

13. Connect Payment method.

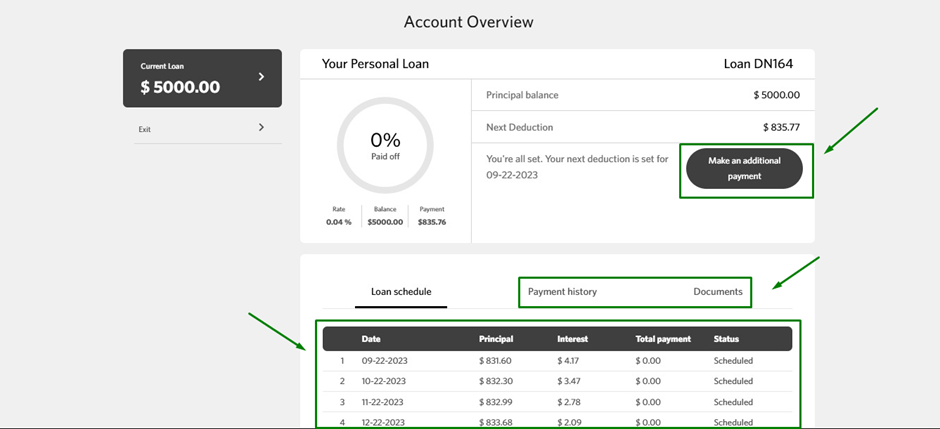

14. You will then be directed to your personal account, where you can:

● repay the loan

● monitor your payment schedule

● download a set of documents

● track payment history

If you need to log out of your personal account, click Exit in the upper left corner of the screen.

If required, you can get back into your personal account at any time by entering your e-mail address and password.